A PAN card, or Permanent Account Number card, is a unique 10-digit alphanumeric identifier issued by the Income Tax Department of India.

It is essential for various financial transactions, such as filing income tax returns, opening a bank account, applying for loans, and more. In today’s digital age, you can easily download your PAN card online if you need a digital copy or have misplaced the physical card.

The download process is simple and can be completed through official portals like NSDL, UTIITSL, or the e-filing website.

PAN Card Download

What is an e-PAN?

An e-PAN is a digitally signed PAN card issued in PDF format. It is legally valid and accepted for all purposes requiring a PAN card.

The e-PAN provides a convenient way to access and store your PAN information digitally, eliminating the need to carry the physical card at all times.

Methods to Download e-PAN

You can download your e-PAN card using the following three official methods:

Download e-PAN from the NSDL Portal

The NSDL (National Securities Depository Limited) portal allows users to download their e-PAN if they applied for their PAN card through NSDL. Follow these steps:

- Visit the NSDL Portal:

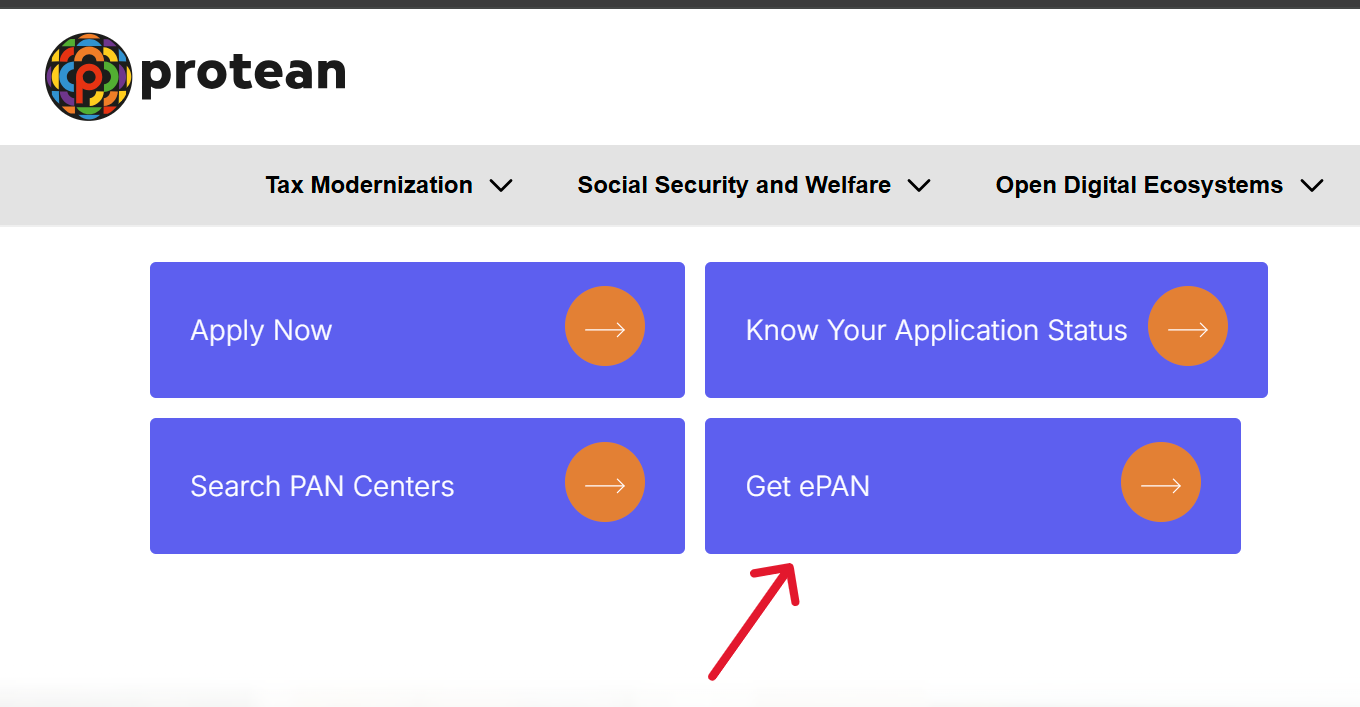

Go to the official Proteantech NSDL website: https://www.proteantech.in/services/pan/. - Locate the e-PAN Download Section:

Navigate to the “Get e-PAN” option under the Protean’s Tax Services section.

- Enter Your Details:

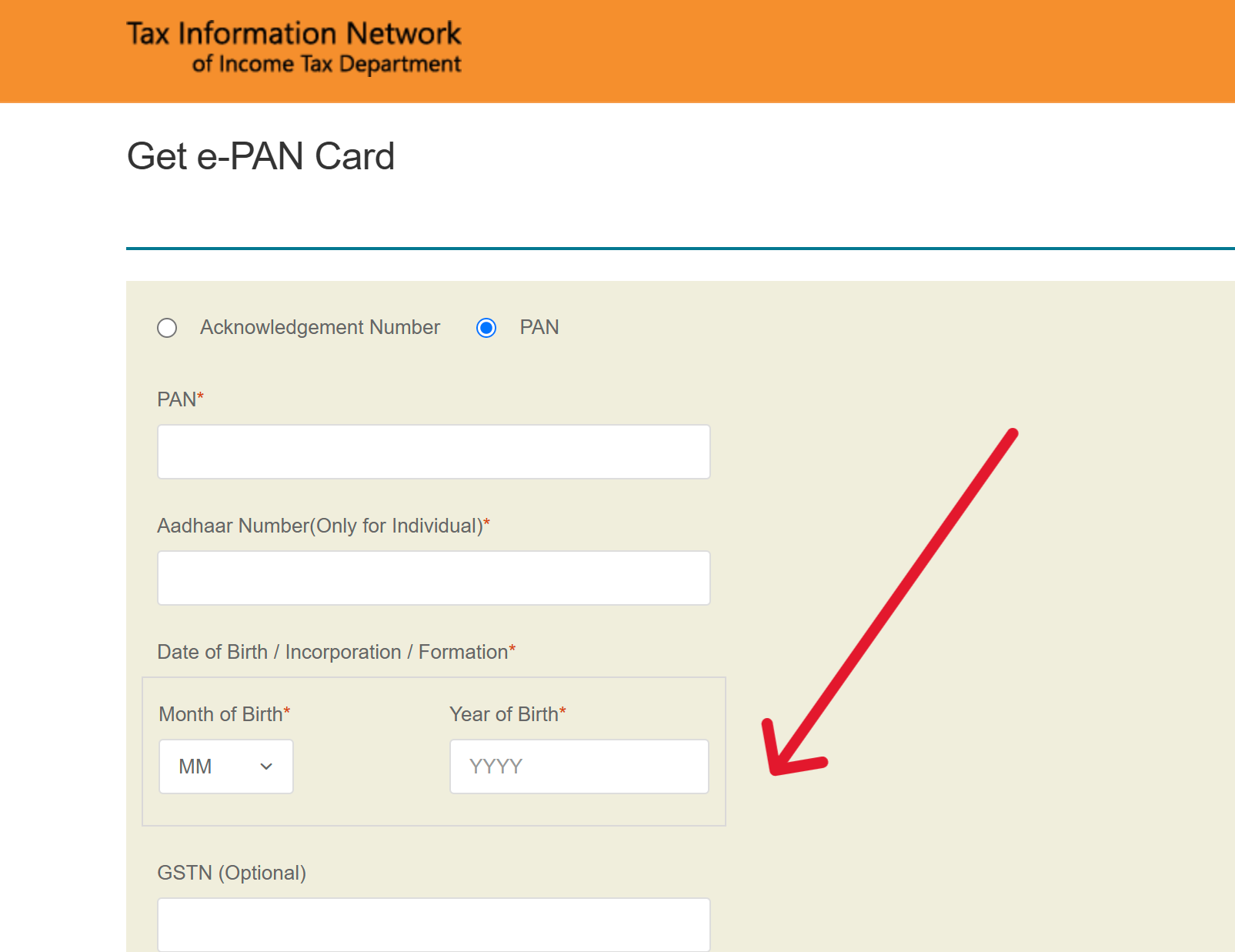

Now you will be redirected to https://www.onlineservices.nsdl.com/paam/requestAndDownloadEPAN.html, on this page fill in the required information, including:- PAN number

- Date of birth

- Aadhar Number

- The captcha code displayed on the screen.

- Complete OTP Verification:

- Enter the OTP sent to your registered mobile number or email ID for verification.

- Ensure your registered details are up-to-date.

- Make Payment (if applicable):

If your PAN was issued or updated more than 30 days ago, pay the fee of ₹8.26 (including taxes). Payment can be made through credit/debit card or net banking. - Download Your e-PAN:

Once verified, you can download the e-PAN in PDF format. A copy will also be sent to your registered email address.

Download e-PAN from the UTIITSL Portal

UTI Infrastructure Technology and Services Limited (UTIITSL) manages PAN services for users who applied through UTIITSL.

If you applied for your PAN card through UTI Infrastructure Technology and Services Limited (UTIITSL), you can download your e-PAN from their portal. Here’s how:

- Visit the UTIITSL Website:

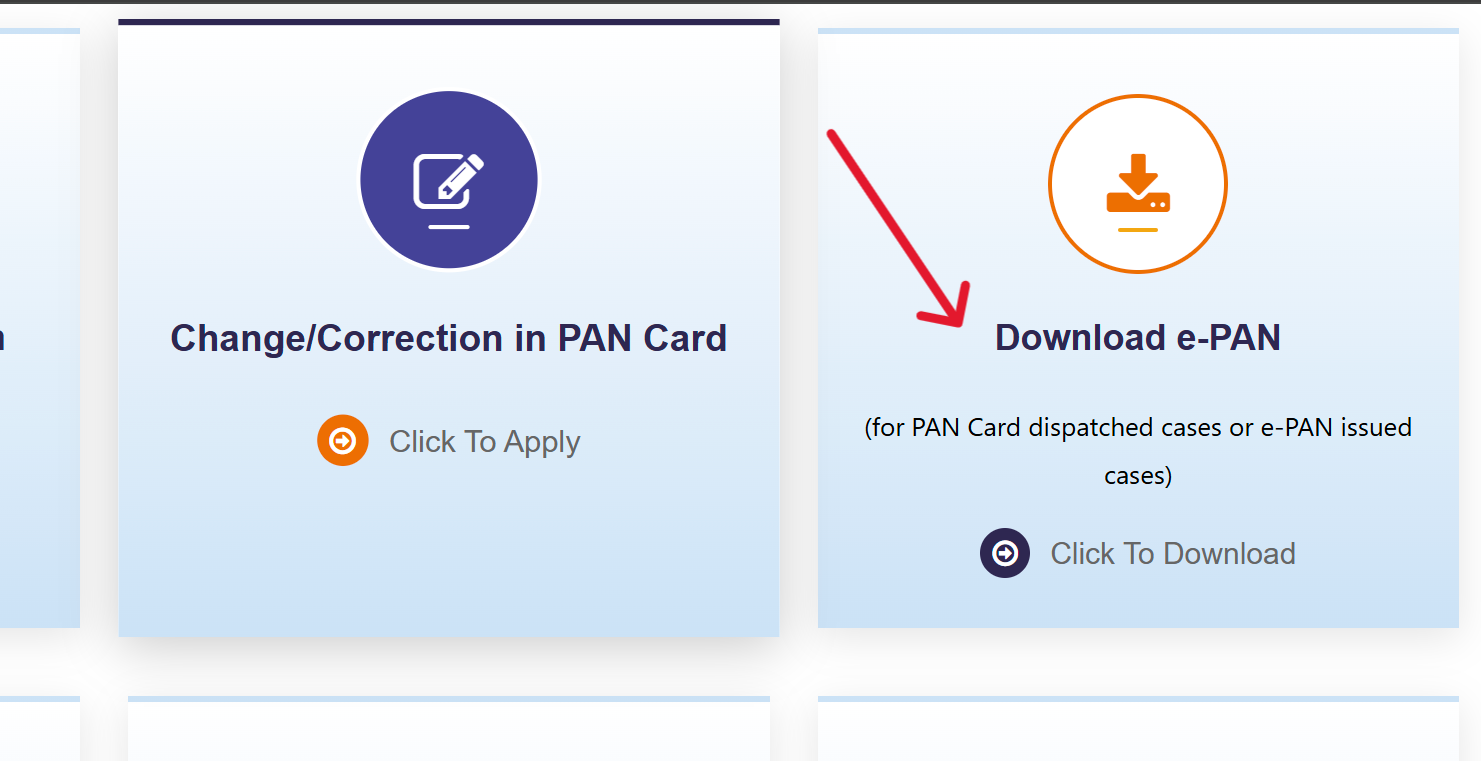

Open the official UTIITSL website: UTIITSL e-PAN Services - https://www.pan.utiitsl.com/PAN/. - Select the e-PAN Download Option:

Click on the “Download e-PAN” link available on the homepage.

- Provide the Required Details:

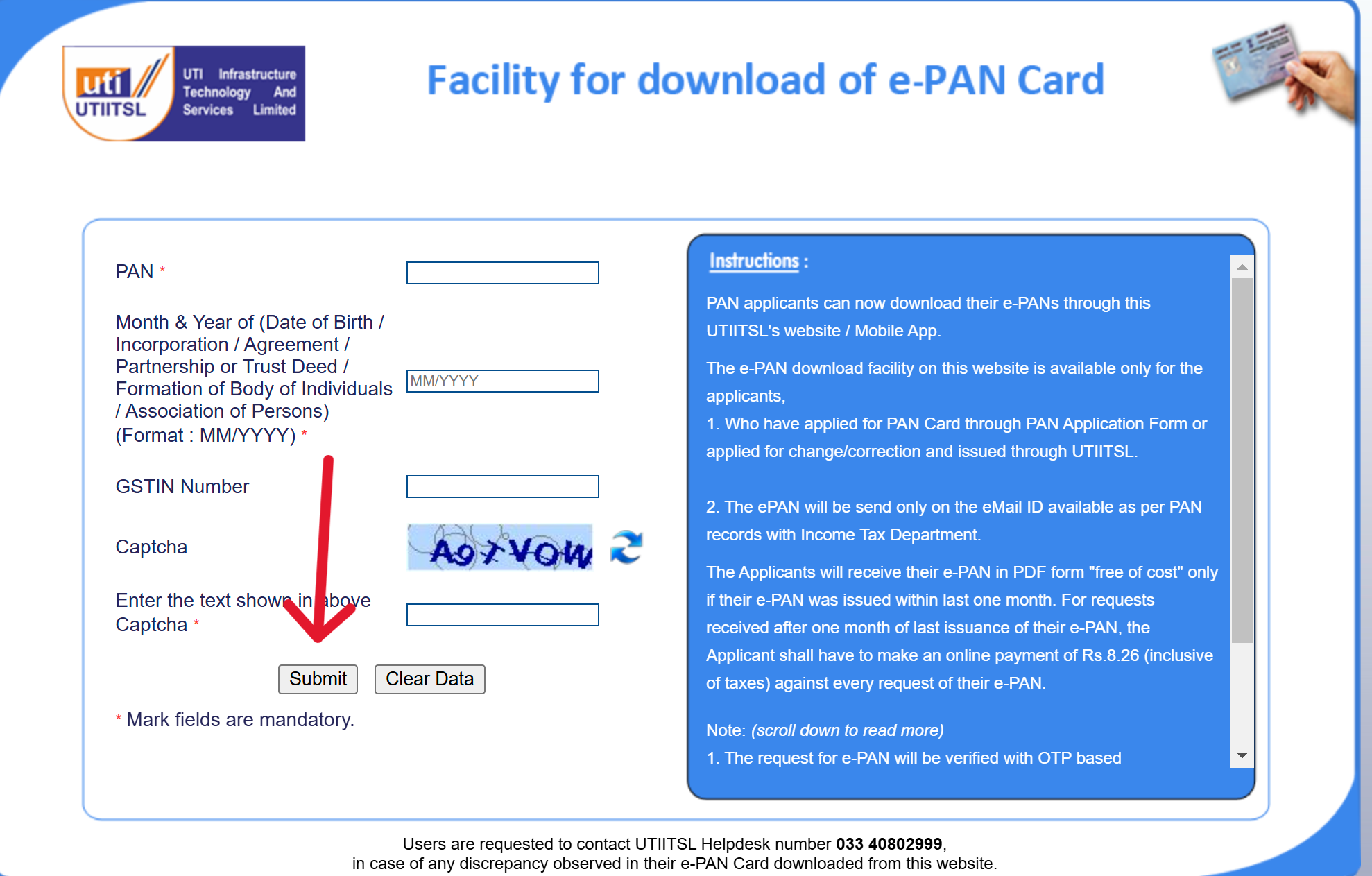

- Enter your PAN number or the application coupon number provided during your PAN application.

- Fill in the captcha code displayed.

- Verify Your Identity:

- An OTP will be sent to your registered mobile number or email.

- Enter the OTP to complete the verification process.

- Pay the Nominal Fee (if required):

A fee of ₹8.26 applies if your PAN was issued more than 30 days ago. For PANs issued within the last 30 days, the download is free. - Download the e-PAN:

After successful verification, you can download the e-PAN as a PDF. It will also be emailed to your registered email address.

Download e-PAN from the Income Tax e-Filing Portal

The Income Tax e-Filing Portal offers a quick and free way to download your e-PAN, especially if you need an instant e-PAN. Here’s the process:

- Access the e-Filing Portal:

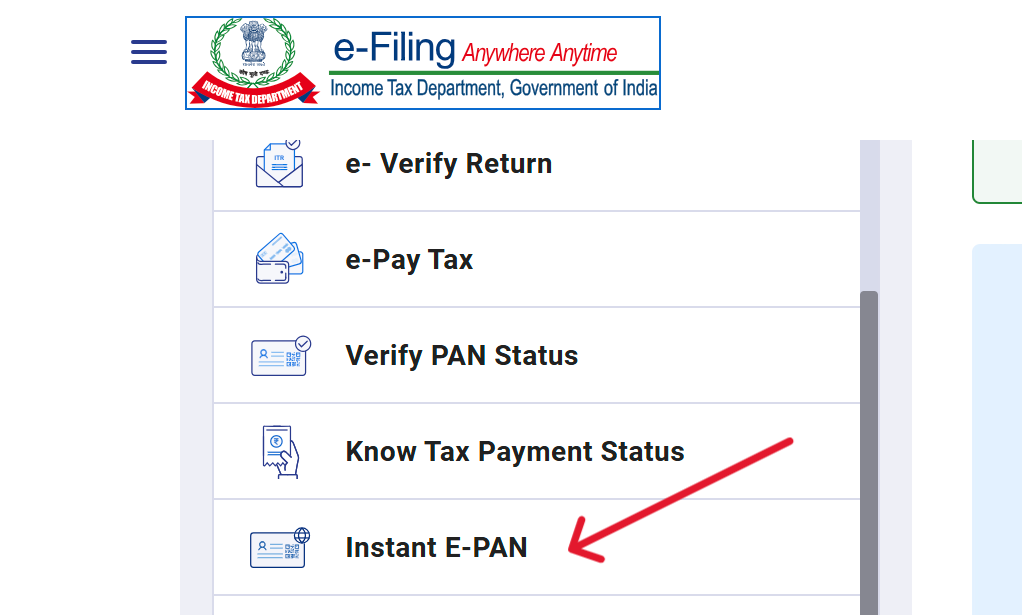

Visit the official e-Filing portal: Income Tax e-Filing Portal. - Navigate to Quick Links Services:

- Under the “Quick Links” section, select “Instant e-PAN.”

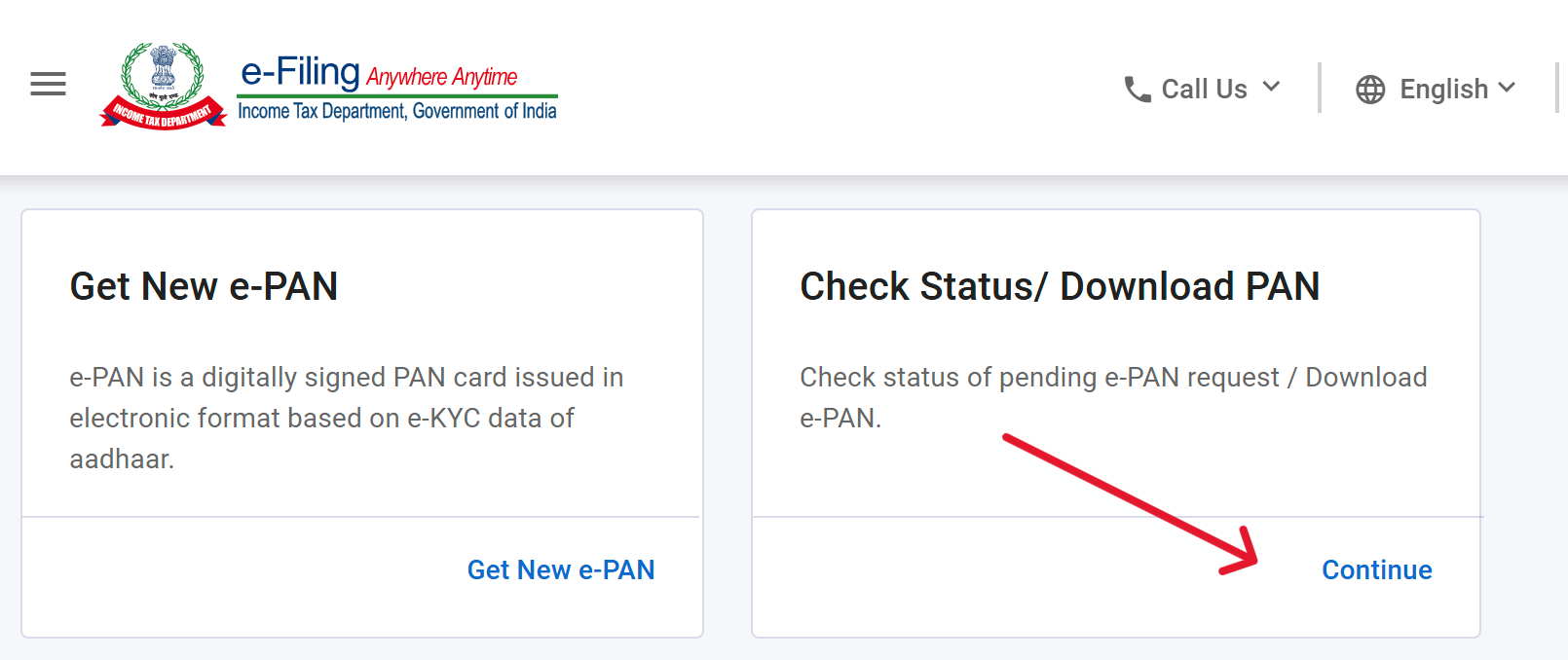

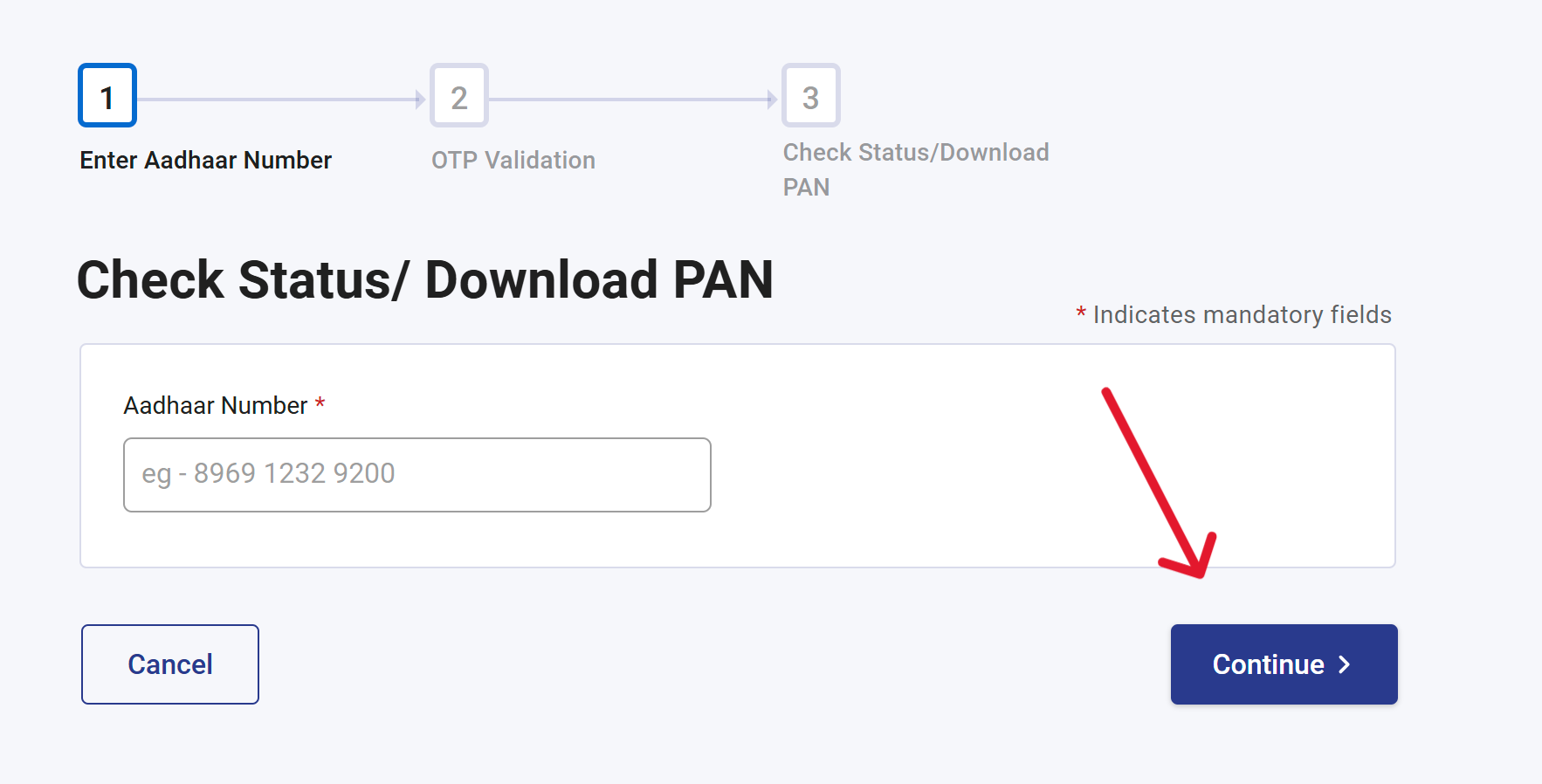

- Click on the Check Status/ Download PAN option, and provide your Aadhaar number.

- Verify Using OTP:

- An OTP will be sent to the mobile number linked with your Aadhaar.

- Enter the OTP to authenticate.

- Download the e-PAN:

Once verified, your e-PAN will be available for download in PDF format. This service is completely free.

E-PAN Password

For security, the e-PAN PDF is password-protected. The password is your date of birth in the DDMMYYYY format. For example:

- If your date of birth is 15th August 1990, your password will be 15081990.

- If your date of birth is 1st January 1985, your password will be 01011985.

This ensures that only you can access your e-PAN, safeguarding your personal information.

Helpline

For any queries or issues related to your PAN card, you can reach out to the respective helplines listed below:

| Service | Contact Numbers | Timings | |

|---|---|---|---|

| UTIITSL Helpline | +91 33 40802999, 033 40802999 | 9:00 AM to 8:00 PM (All Days) | utiitsl.gsd@utiitsl.com |

| NSDL Helpline | (020) 272 18080 | 7:00 AM to 11:00 PM (All Days) | Not Available |